Renting Accommodation for Business Travel

Business travel is an integral part of many professions, requiring employees to stay productive while away from their home base. One of the critical aspects of planning a business trip is selecting appropriate accommodation. The right choice of lodging can significantly impact an employee's comfort, productivity, and overall experience during the trip. Furthermore, understanding how to calculate and track travel expenses is crucial for both employees and employers to ensure financial efficiency and compliance with corporate policies and tax regulations. This article will explore the essentials of choosing a hotel for a business trip, the calculation of per diems, and the best practices for tracking travel expenses.

How to Choose a Hotel for a Business Trip

Common Types of Accommodation for Business Travel

When it comes to business travel, several types of accommodations can be considered:

When it comes to business travel, several types of accommodations can be considered:

- Hotels: The most common choice, offering various amenities tailored for business travelers.

- Serviced Apartments: Ideal for longer stays, providing a home-like environment with kitchen facilities.

- Corporate Housing: Fully furnished homes or apartments rented specifically to corporate clients.

- Airbnb or Vacation Rentals: Increasingly popular, especially for longer stays or when more space is needed.

Criteria for Selection: Location, Price, Amenities, Reviews, and Transportation

Choosing the right hotel involves several key criteria:

- Location: Proximity to the business venue, client offices, or conference centers is paramount. It saves travel time and costs.

- Price: Staying within the company's budget is essential. Look for negotiated corporate rates or discounts.

- Amenities: Business travelers may need Wi-Fi, a business center, gym, and dining options. Verify the availability of these facilities.

- Reviews: Online reviews from previous guests provide insights into the quality of service and overall experience.

- Transportation: Easy access to public transport or availability of shuttle services can be a significant advantage.

Tips for Finding the Right Hotel

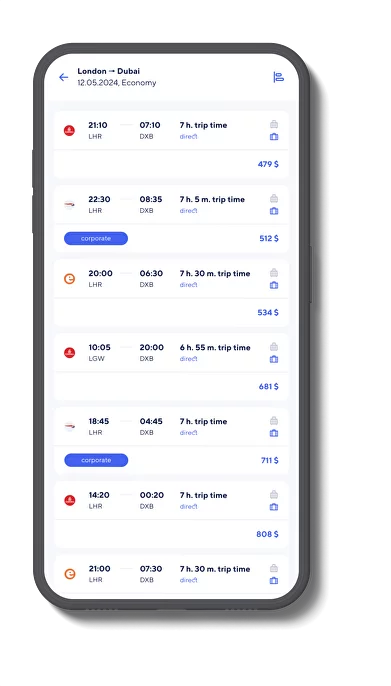

- Use Professional Booking Services: Platforms like Concur, Egencia, and TripActions specialize in business travel and can offer negotiated rates and additional services.

- Corporate Recommendations: Many companies have preferred hotel lists or partnerships with certain hotel chains, ensuring consistent quality and service.

- Special Considerations for Corporate Clients: Some hotels offer specific amenities like conference rooms, early check-in/late check-out options, and loyalty programs tailored for business travelers.

Booking Tips for Corporate Clients

Corporate clients can often take advantage of several booking benefits:

- Advance Booking: Secure better rates and availability by booking well in advance.

- Flexible Policies: Opt for hotels with flexible cancellation policies to accommodate any changes in travel plans.

- Loyalty Programs: Enroll in hotel loyalty programs to earn rewards that can benefit both the employee and the company.

How Per Diems Are Calculated

Definition of Per Diems

Per diems are daily allowances provided to employees to cover the cost of meals, lodging, and incidental expenses during business travel. They are designed to simplify the reimbursement process by offering a fixed amount rather than requiring receipts for every individual expense.

Methods of Calculation

- Daily Allowance: A set daily rate is provided to cover all expenses. This rate varies based on the destination and length of stay.

- Reimbursement of Actual Expenses: Employees submit receipts for all expenses incurred, and these are reimbursed by the employer.

- Combined Methods: Some companies use a mix of per diems and actual expense reimbursement, depending on the nature of the expenses.

Tax Implications

- Deductible Expenses: Certain travel expenses, such as lodging, meals, and transportation, can be deducted for tax purposes. It's essential to keep detailed records and receipts.

- Required Documentation: To qualify for tax deductions, companies must maintain proper documentation, including travel itineraries, receipts, and a clear justification for the travel.

Tracking Business Travel Expenses

Importance of Accurate Expense Tracking

Accurate tracking of business travel expenses is crucial for several reasons:

- Financial Transparency: Ensures that all expenses are accounted for and within budget.

- Tax Compliance: Proper documentation is required for tax deductions and to avoid penalties.

- Policy Adherence: Ensures compliance with corporate travel policies and prevents fraud or misuse of funds.

Using Corporate Cards

- Advantages: Corporate cards simplify the tracking of expenses, provide detailed statements, and often come with additional perks like travel insurance.

- Disadvantages: Potential for misuse if not monitored carefully. It’s essential to have strict policies and regular audits.

Automating Expense Tracking

Modern technology offers various solutions for automating expense tracking:

- Expense Management Software: Tools like Expensify, Concur, and Zoho Expense streamline the process of recording, approving, and reimbursing expenses.

- Mobile Apps: Many expense management tools offer mobile apps that allow employees to capture receipts and track expenses on the go.

- Integration with Financial Systems: These tools often integrate with corporate financial systems, ensuring seamless data transfer and reporting.

Reporting and Compliance

- Transparency: Regular reporting ensures that all stakeholders are aware of travel expenses and any deviations from the budget.

- Adherence to Corporate Policies: Clear guidelines and regular training help employees understand and comply with travel policies.

- Regulatory Compliance: Ensuring that all expenses are documented and reported according to tax laws and corporate governance standards.

Selecting the right accommodation, accurately calculating per diems, and meticulously tracking expenses are fundamental aspects of managing business travel. By following best practices and leveraging modern tools, companies can optimize their travel budgets, ensure compliance with tax regulations, and provide their employees with a comfortable and productive travel experience. Proper planning and execution of these tasks not only enhance the efficiency of business operations but also contribute to the overall satisfaction and well-being of traveling employees.