What’s going on at Intel, the largest beneficiary of the U.S. push to onshore chip manufacturing? While the semiconductor industry was still reeling from a Bloomberg report about TSMC in talks for a controlling stake in Intel Foundry at the Trump administration’s request, The Wall Street Journal threw another stunner about Broadcom considering a bid for Intel’s CPU business.

Intel, once a paragon of semiconductor technology excellence, has been on a losing streak for nearly a decade. Pat Gelsinger, the company’s overly ambitious former CEO, made an expensive bid to take Intel into the chip contract manufacturing business, which eventually became a liability for the Santa Clara, California-based semiconductor giant.

|

|

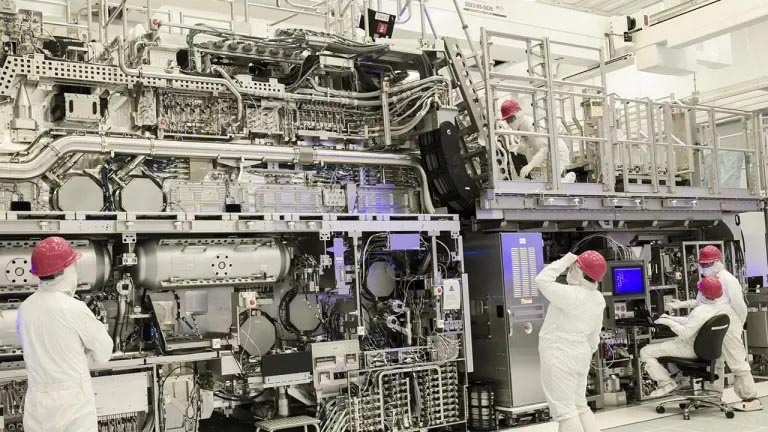

| Figure 1. | Despite its financial woes, Intel has the largest and most advanced chip manufacturing operation owned by a U.S. company. |

Meanwhile, it continued to lose market share in its bread-and-butter CPU business to archrival AMD and largely ceded the artificial intelligence (AI) chips boom to Nvidia. In this backdrop, according to Bloomberg, the previous U.S. administration considered Intel Foundry’s merger with GlobalFoundries (GF), which produces older generation chips and abandoned cutting-edge process nodes years ago.

While that was a non-starter, the present U.S. administration seems to have taken a more pragmatic approach by engaging TSMC to take partial ownership of Intel’s fabs, thus throwing a financial lifeline to money-losing Intel. Moreover, TSMC, in full control of its chip manufacturing operations, is expected to bring stability with its highly successful fabrication process recipes.

However, as the Bloomberg report points out, these talks are in an early stage and it’s not clear what’s in it for TSMC. While Taiwanese super fab expressed its lack of interest in Intel’s foundries a few months ago, its about-face on this matter seems to be linked to the current geopolitical turmoil. More details on this matter are expected to emerge in the coming days.

Broadcom eying Intel’s CPU business

The case for Broadcom potentially acquiring Intel’s CPU and related design businesses is less mysterious. The WSJ story claims that Broadcom is studying the possibility of acquiring Intel’s chip design business. If this matures alongside TSMC’s potential takeover of Intel Foundry, it’ll be the end of the road for the Intel brand as we know it.

However, the report clarifies that, like the TSMC matter, Broadcom’s talks regarding Intel are preliminary and largely informal. Furthermore, Broadcom will only proceed if Intel finds a manufacturing partner; here, it’s important to note that Broadcom and TSMC are working separately.

|

|

| Figure 2. | Despite losing market share to AMD and Nvidia, Intel owns a rich array of semiconductor design resources and patents. |

The semiconductor industry rumor mill is in full swing, and we are likely witnessing the fall of an American corporate icon in real-time. This is a stark remainder of the semiconductor industry’s hyper competitive nature, which doesn’t spare missteps of even storied companies like Intel.

Intel’s woes are clearly beyond the reflection phase, and the damage done during Gelsinger’s tenure seems irreparable. However, the U.S. administration also sees Intel as an entity critical to national security. Will that be a blessing in disguise or a catalyst for its quick demise? Time will tell.